President-elect Trump convened at his New York home, a group of America’s most illustrious

technology-company CEOs (including Tim Cook, Elon Musk, and Jeff Bezos), and

proceeded to present to them:

"I'm here

to help you folks do well. And you're doing well right now. And I'm very

honored by the bounce. They're all talking about the bounce. So right now

everyone in this room has to like me just a little bit."

If “they’re all” pleasantly talking

about the bounce, then why shouldn't we? Despite

many impotent warnings that the market would respond with a massive crash,

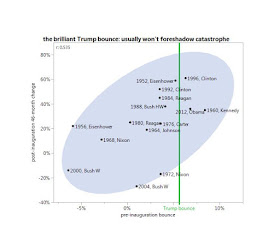

the S&P 500 has instead charged ahead 5.6% on a continuous basis. From election, to inauguration. This bounce is the 4th best

of the 17 elections on record since 1950 (the S&P 500’s birth year). So it's fine, but not extreme. What’s perhaps even more distinct is that the

market has been hushed along the way, with an average daily volatility of just 0.4% (the 2nd best on record!)

Now this combination is not only exhilarating for those invested in the markets (which we should all be),

but what is even more alluring is the returns we typically enjoy from here (from inauguration, to the following election) is not as muted as mean-reversionists expect (link, link). See the vertical “post-inauguration change” axis, on the chart below, along with the bounds of the 90% confidence interval ellipse.

The residual pattern however as shown through the shaded ellipse is forceful,

with a blunt correlation of >½. We notice,

per the vertical green line, that a strong bounce isn’t in any way a

negative signal for the foreword 46 months before the 2020 elections! One decree is to shun being negative, as most (including mainstream media pollsters) were

heading into the election. And appreciate that things may

easily turn out satisfactory (even if not it is not as if anyone could accurately predict such demise a priori).

Of course many will still choose to chase for other corroborative information to suit their wants. And arguably there are many contexts one might

want to consider, such as what political party was in office, did an incumbent

candidate get re-elected, were we in a recession, contemporary geopolitical risks, etc. But with less than 20 elections in our historical sample, that’s simply too minor a data-set size for additional factor analysis.

So simply relish the market rise that we’ve had

thusfar, and know that Monday will promise to be the start of what can be many more wonderful

years. Despite the country's partisan extremes, it pays to always bet on America. And do what you can to provide opportunities to one another, regardless of your station in life!

No comments:

Post a Comment